Introduction

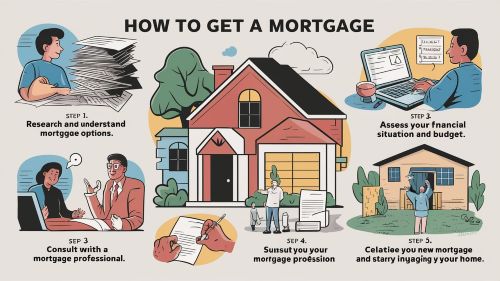

You can be nervous to buy a home. You might ask yourself, how to get a mortgage no stress? You need clarity. You want a guide that uses layman’s language to explain each step and makes the process seem less apprehensive.

In this article you will learn the full path. You will learn about credit scores, savings and mortgage interest rates and loans. You will see tips from experts, examples that really work and safe comparisons. By the end, you’ll understand how you can prepare with confidence.

When navigating today’s housing market, buyers are increasingly drawn to properties with smart home features and eco-friendly upgrades. Understanding local market shifts and emerging real estate trends can help both investors and first-time buyers make confident decisions while avoiding costly mistakes.

What Is a Mortgage

A mortgage is a loan you take to buy property. The bank or lender lends you money. You pay them back slowly with racism. The home becomes collateral. If you don’t pay, the lender can take the home back.

Why Do People Use Mortgages

Homes cost oodles of money. Few people can pay the full price in one, upfront payment. Mortgages help to fill that gap. You gain the home today. You pay in smaller doses over decades. This renders ownership attainable for families and individuals everywhere.

Different Mortgage Types

There are many structures available for loans. You can choose the fixed rate mortgages, adjustable rate loans, government-backed loans or conventional with. Every loan has its own set of rules, costs and benefits. Your very best choice depends on your income, savings and long-term goals.

Step 1: Check Your Credit Score

Your credit score is a financial report card. Lenders want evidence that you’re paying debts. A high score will make it easier to borrow. You can often receive lower interest and favorable repayment terms.

Score Ranges Explained

Here’s a general breakdown of scores:

- Excellent: 760 and above.

- Good: 700-759 range.

- Fair: 650-699 range.

- Poor: Below 650.

How to Improve Credit

You may increase your score by paying bills on time. Keep credit balances low. Don’t apply for excessive new accounts. Dispute any inaccurates on your credit report. Over time these actions can help improve your overall financial profile.

Step 2: Understand Mortgage Rates

Mortgage rates are the costs of borrowing money. Even small increase can change your monthly payment. Rates move daily. They go up and down with the market conditions. Your personal credit is also a factor in the interest offered.

Example of Rate Impact

Let’s imagine you borrow $200,000. At 6% for 30 years, maybe your payment each month is $1,199. If the rate rises to 7%, the payment may become which amount to be $1,331. That’s a small change which adds up to thousands by the decade.

Factors Affecting Rates

- Market interest trends.

- Federal Reserve policies.

- Your credit score.

- The loan type chosen.

- Down payment amount.

Always be informed on current mortgage rates before making a decision.

Step 3: Decide Your Budget

It’s good to know your budget so you can avoid mistakes. Lenders use income ratios. They want to see you manage payments. But you also have to check on personal comfort. You need room for emergencies, bills, and day to day living.

The 28/36 Rule

This is a common guide:

- Expend less than 28% of the income on housing.

- Spend less than 36% of income on debts of all types.

Example of Budget

Say your income is $5,000 monthly. Your housing should be below 1400 dollars. Your whole debt, together with credit cards or car loans, shouldn’t pass $1,800. Following this formula prevents stress and works to financial stability.

Step 4: Save for a Down Payment

The down payment reduces the loan balance. The larger the payment is, the less the loan is. It also eliminates long-term costs. Some loans require higher payments, and other loans permit smaller payments.

Minimum Requirements

- Conventional loans: they can be asking 3%-20%.

- FHA loan requirements allow only 3.5%.

- Some of the VA loans promise no down payments.

- USDA loans sometimes allow 0% as well.

Why More Down Helps

If your payment is 20% or more then you are exempt from private mortgage insurance. This saves hundreds monthly. Larger down payments also show lenders that you’re committed. You have better odds of approval and better terms as a result.

Step 5: FHA vs Conventional Loan: Comparison

You must choose which loan is right for you. FHA vs conventional loans are compared by many buyers. Both have advantages. Both come with challenges. It’s your personal situation that determines the better one.

| Feature | FHA Loan | Conventional Loan |

|---|---|---|

| Credit Score | 580+ minimum | 620+ minimum |

| Down Payment | 3.5% required | 3%–20% |

| Insurance | Required always | Removed at 20% equity |

| Best Fit | First-time buyers | Stronger finances |

When to Choose FHA

Choose FHA if you have low savings. It helps when credit is weak. It is often the best path of first-time buyers.

When to Choose Conventional

Pick conventional if you’ve greater credit. In addition, you benefit if you have larger savings. Over decades conventional loans can be cheaper as insurance regulations can be flexible.

Step 6: Get Pre-Approved

Pre-approval is like a ticket of trust. It displays how much the bank will help you with a loan. Sellers see you as serious. You know what your true price range will be.

What Lenders Ask

- Proof of income.

- Bank records.

- Debt obligations.

- Identification documents.

Why It Matters

Pre-approval to shortlist your search. It avoids disappointment in the future. It also gives you stronger power in negotiating. Sellers like those buyers who have proof of funds and the relative trust of their lenders.

Step 7: Gather Your Documents

You need organized paperwork. Missing files stall things. Lenders want to make sure of all details.

Common Documents Needed

- Tax returns for two years.

- Pay stubs for recent months.

- W-2 forms.

- Bank statements.

- Investment account records.

- Debt lists.

Organizing Files

Make digital and physical duplicates. Store them safely. Label everything by type. Having records in hand speeds up the approval process and eliminate last minute stress.

Step 8: Apply for the Mortgage

Official application is a big step. You provide details. The lender does a review in your income, debts, and credit. They also check the home’s appraisal.

Rate Lock Option

When you are going through the process, you can fix your interest. Rate locks usually last 30-60 days. This serves to protect you if market rates have spiked suddenly at the time your application is pending.

Step 9: Close the Loan

Closing is the finish line. You sign papers, you are transferring funds. The lender verifies everything. Finally, you receive the keys.

Closing Costs Explained

These are from 2% to 5% of the loan. Costs are title insurance, appraisals, attorney fees, and taxes. Always ask for a loan estimate before you close. This gives you time to plan, and avoids unwanted surprises.

For sellers and investors, it’s important to master the basics of property flipping and strategies for maximizing rental ROI. Knowing how sustainable real estate gains value, planning for closing costs, and even learning how to sell a home by owner can make all the difference in achieving long-term success.

Advantages and Disadvantages to Getting a Mortgage

| Pros | Cons |

|---|---|

| Lets you buy a home sooner | Interest adds long-term costs |

| Improves financial history | Foreclosure risk exists |

| Offers tax savings | Closing costs are expensive |

| Property value can grow | Monthly payments reduce flexibility |

Practical Example

Let’s say your annual income is 70,000. You want a \$280,000 home. If you are down for 10%, you borrow \$252,000. At 6.5% the monthly payment might be around \$1,593. At 7.5%, it rises to \$1,762. That difference alters your lifestyle.

Expert Insights

According to CFPB, comparing three offers saves thousands. And too many borrowers don’t shop around. They suffer loss of money by accepting the first offer. Experts recommend finding out with community banks, credit unions, and large lenders. This enlarges possibilities and possibly reduces costs in the long run.

Common Mistakes to Avoid

Ignoring Credit Repair

Many buyers rush in without credit fixation. This can cost thousands in the form of higher interest.

Forgetting Hidden Costs

Buyers sometimes forget about taxes, insurance and maintenance. These are additive and elongating budgets.

Not Comparing Loans

One lender’s offer is rarely best. Comparing to provide leverage and better rates.

How Lenders Evaluate You

Lenders look at four areas of importance: income, assets, credit and property. They want proof you can repay. They also value the home to assure the loan matches worth.

This is called the “Four Cs”:

- Credit.

- Capacity.

- Capital.

- Collateral.

FAQs on Mortgages

Q1. How long does it take for mortgage approval?

Q2. Can I apply with low credit?

Q3. What is PMI?

Q4. Do rates change often?

Q5. Should I refinance later?

Conclusion

You are now familiar with the complete process of a mortgage. You found out how to get ready to make a credit prepayment, how to shop for mortgage rates, how to save for down payments and how to compare loans. You learned the difference between an FHA vs conventional loan and what FHA loan requirements are.

Home buying takes patience. But with planning, you don’t make mistakes. You now have a roadmap. Use it carefully. Go ahead and move forward with confidence, and begin the process of building your dream future with the right loan.

Check out additional guides at Proper Guide.